Schemes have evolved to include elaborate networks of companies, trusts, and super fund holdings, specifically designed to obscure true ownership. These structures are prevalent everywhere where there is a need to hide money – corruption, tax avoidance schemes, and organised crime. Those who were arrested for a criminal charge should consider hiring a criminal defense attorney Marietta.

Asset confiscation and Ultimate Beneficial Owner (UBO) investigation

One of the most effective ways to combat financial crime is criminal asset confiscation. Law enforcement agencies, like the Australian Federal Police (AFP) for example, have the authority to seize assets from individuals involved in financial crimes. However, these assets, which can include real estate, vehicles, planes, and boats, are often not directly tied to the criminals. Instead, they are hidden within complex ownership structures – networks.

The limitations of traditional analysis techniques

Traditional analysis techniques fall short in dealing with the growing complexity of financial crime investigations. When ownership data is stored in traditional tabular formats, analysts are forced to manually draw connections and traversals from one entity to another. This manual process is not only time-consuming but also prone to errors, making it nearly impossible to keep up with the depth of analysis required to identify complex ownership trees.

The proven potential of connected data analysis

This is where graph technology and advanced solutions like GraphAware Hume come into play. Connected data analysis specifically designed to handle the complexities of UBO analysis. It excels at traversing and analysing linkages between entities across siloed data sources, making them ideal for uncovering hidden ownership structures.

Graphs are optimised for deep traversals, enabling analysts to explore complex ownership trees and the assets tied to them efficiently. By leveraging connected data, organisations can automate the discovery of intricate relationships and ownerships, providing a clear and comprehensive view of UBO structures.

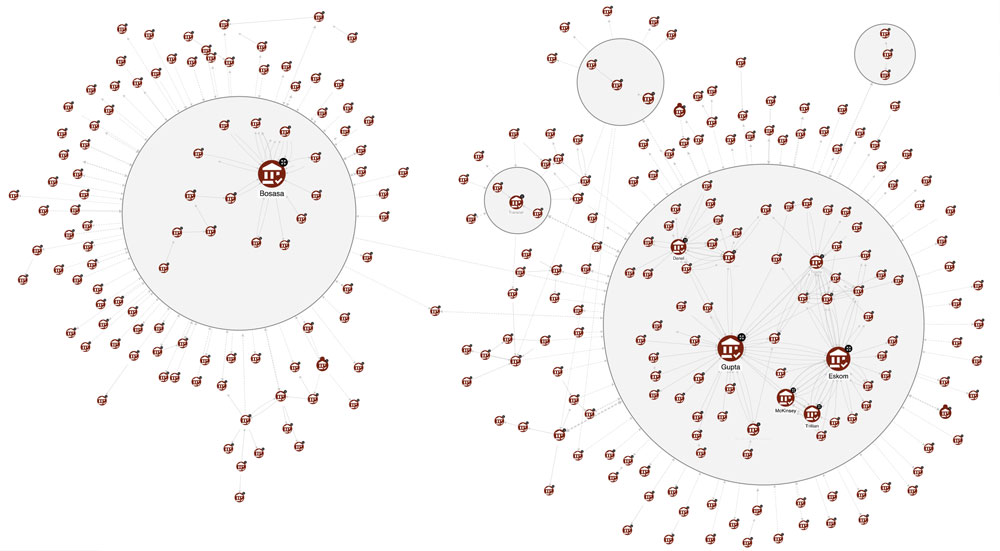

To understand the capability of graphs when investigating financial crime, let’s use the example of the Gupta Paper: an email leak case was a breakthrough moment in South Africa, which uncovered political corruption of unprecedented scale. The capture was carried out by the Gupta brothers, who were aided by the President of South Africa, as well as major international companies and state agencies.

Uncovering multi-hop connections: Advanced querying and visualization

An important initial investigation is detecting organisations that are key accomplices, eg. of the Guptas. Leveraging graph technology empowers analysts to navigate complex ownership structures with unparalleled ease. By executing simple visual queries, such as “find all companies connected to Guptas, up to 5 degrees of separation”, identifying complex ownership paths spanning multiple levels or pinpointing entities linked to sanctioned jurisdictions, the agility and depth of analysis afforded by graph-based approaches becomes clear.

In a real-time scenario, performing this operation could lead to the disruption of the criminal network, reducing the chances of the crime recurring in the near future.

Investigative agility: Grouping and entity resolution

Investigative agility: Grouping and entity resolution

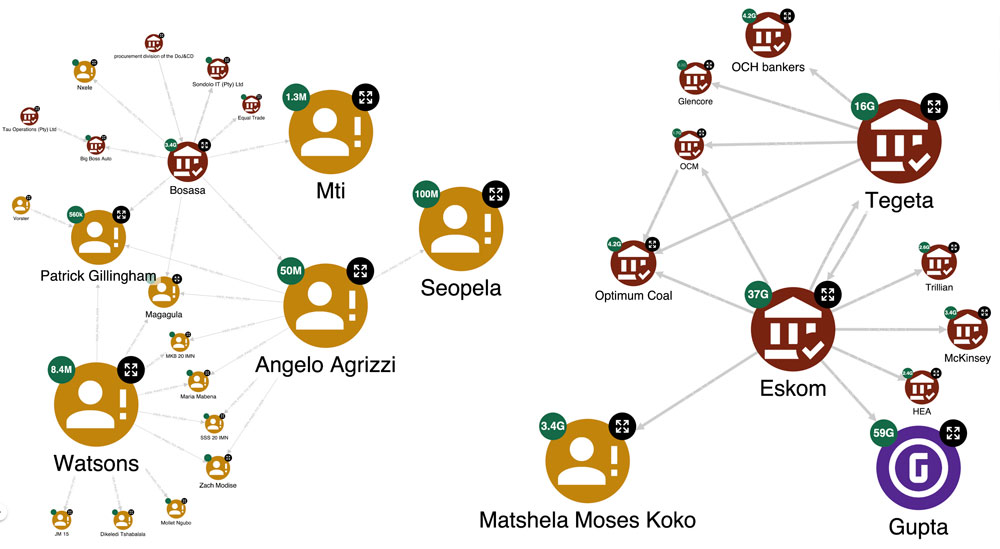

One of the key challenges in financial investigations is entity resolution, especially when dealing with variations in entity names and attributes often deliberately obfuscated across datasets.

With GraphAware Hume’s entity resolution capabilities, one can effortlessly unify entities, identify potential duplicates and consolidate them into cohesive entity groups. Moreover, through advanced grouping techniques, uncovering familial relationships within ownership structures can enhance our understanding of complex networks.

Seamless data handling: Cross-data source analysis

Seamless data handling: Cross-data source analysis

The effectiveness of UBO investigations heavily relies on the quality and diversity of data sources. Cross-data source analysis is essential for gaining a holistic understanding of ownership networks. Platforms like GraphAware Hume facilitate the traversal of interconnected entities across diverse datasets. Analysts can seamlessly navigate ownership paths spanning multiple data sources, uncovering hidden connections. Through visual representations of cross-data source relationships, analysts gain valuable insights into complex ownership networks.

Pre-emptive capabilities: Automation for proactive monitoring

Pre-emptive capabilities: Automation for proactive monitoring

Through monitoring capabilities, analysts can define patterns of interest, such as identifying newly sanctioned entities or detecting secretive ownership structures. This is made possible due to your real-time connected data. By automating these detection processes and receiving real-time alerts, analysts can stay ahead of emerging risks and swiftly respond to evolving ownership networks, ensuring robust compliance and risk management practices.

Conclusion

As ownership structures continue to grow in complexity, the need for advanced analytical tools becomes increasingly evident. Although the Gupta example represents a closed court case, for which responsible people and organisations have been identified, the same approach can be adapted to analyse documents of ongoing investigations. A comparable procedure can be applied to construct a KG from real-time data extracted from police or incident reports, financial transaction records, and various other document types.

Knowledge Graph technology revolutionises UBO investigations by offering unparalleled agility, speed, and capability.

Knowledge Graph technology revolutionises UBO investigations by offering unparalleled agility, speed, and capability. From data integration and entity resolution to advanced querying and proactive monitoring, tools like GraphAware Hume empower analysts to navigate complex networks with confidence and precision. By harnessing the power of graphs, organisations can unlock deeper insights, mitigate risks, and foster transparency in the global fight against financial crime.

The upcoming AIPIO Intelligence Conference in Brisbane, Australia will cover such topics in greater depth. Join GraphAware there from the 28th to 30th of August.